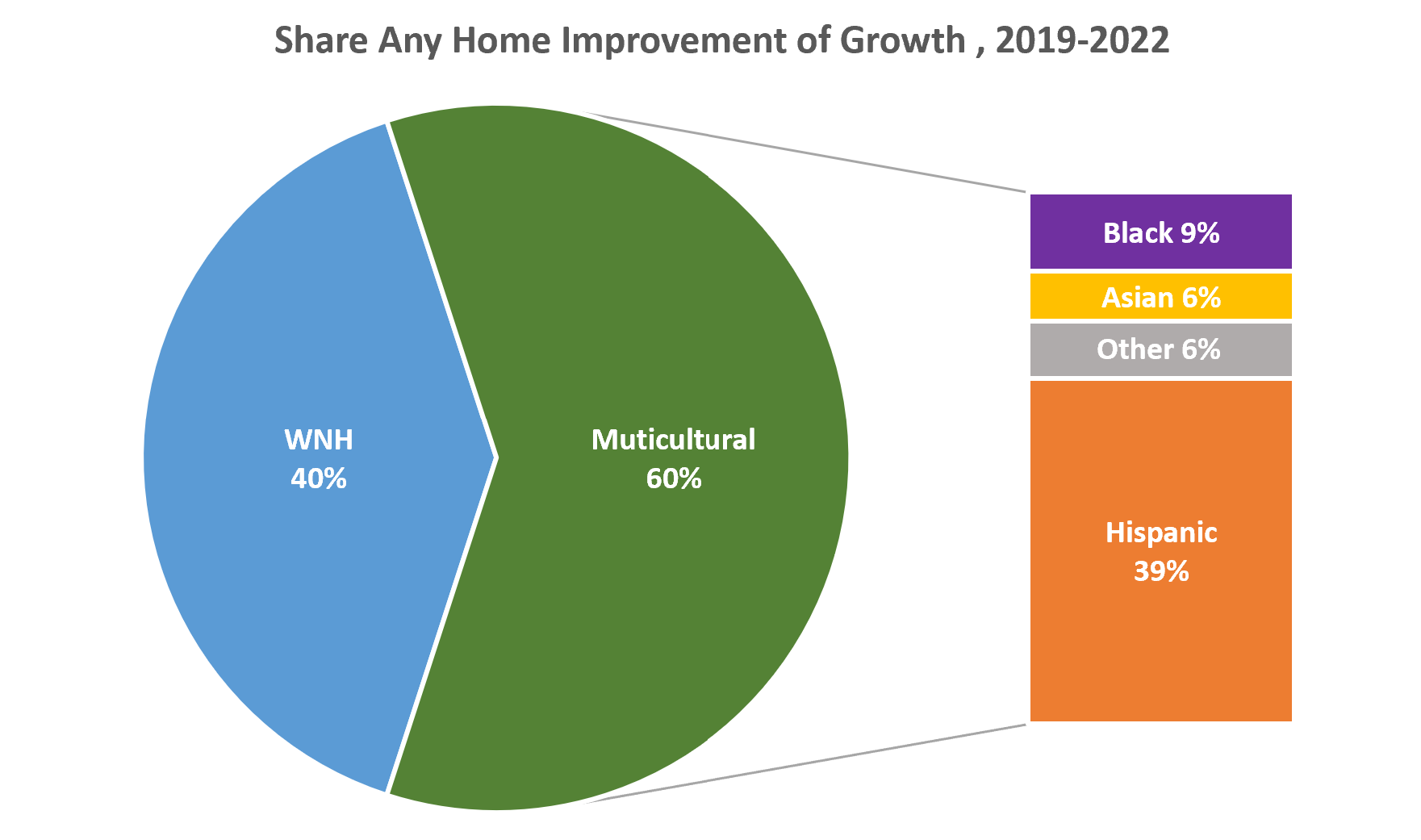

Multicultural (MC) segments are leading the growth in the Home Improvement category, despite the spike in the price of building materials. Multicultural segments account for 60% of the share of growth, with Hispanics accounting for 39%, Blacks for 9%, and Asians for 6% of the total growth of consumers making home improvements in 2022. The high share of growth among Hispanics, Blacks, and Asians is a strong indication that Multicultural segments refocused on their families during the pandemic by improving their homes.

Figure 1 Percent Share of Growth for Any Home Improvement, 2019-2022; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

Figure 1 Percent Share of Growth for Any Home Improvement, 2019-2022; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

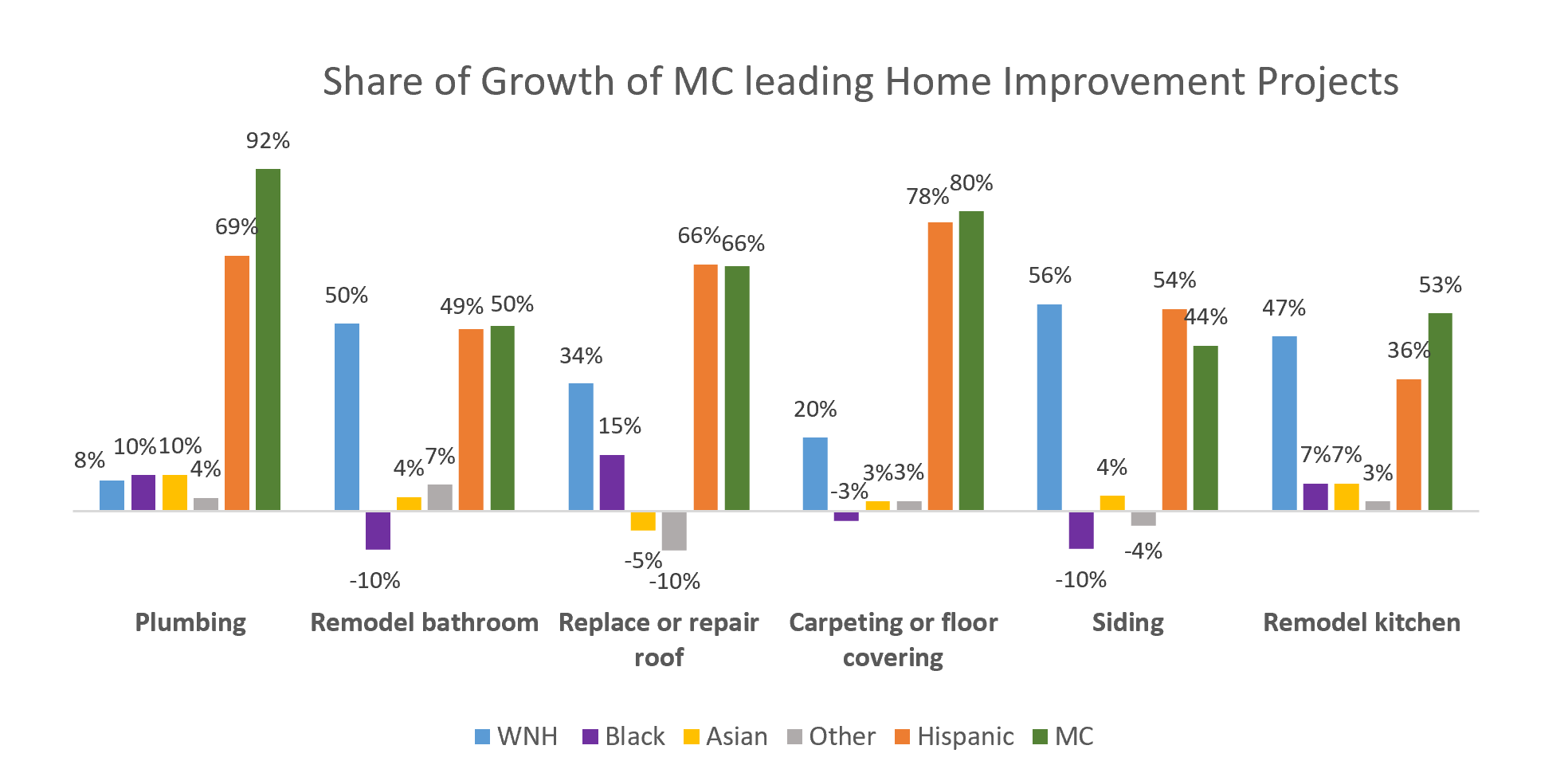

Multicultural segments are leading in the share of growth of DIYs (do-it-yourself) including interior painting, wallpapering, landscaping, bathroom remodeling, and exterior painting. Hispanics take the lead in all Home Improvement categories, with carpeting or floor covering at 78% of all the U.S. growth and kitchen remodeling at 36% -way over indexing their 19% share of the US population. The Asian share of growth is higher (7%-10%) across 2 categories (Plumbing, Kitchen Remodeling), outpacing the 6% share of the Total US Population for the Asian segment. The African American/Black segment had the largest share of growth for replacing or Repairing roofs at 15%. For additional categories’ share of growth please visit AIMM’s Power Up report page 23.

Figure 2 Percent Share of Growth of MC leading Home Improvement Projects; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

Figure 2 Percent Share of Growth of MC leading Home Improvement Projects; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

Factors like an increase in Home Ownership, the price of contractors, and the price of materials contribute to the higher cost of Home Improvement projects. While this analysis uncovered interesting trends in home improvement categories among Multicultural segments, a deeper dive would be required to understand the motivations to embark on a home improvement project, the timeline new mortgage interest rates, the demand for home improvements will continue to increase through 2023.

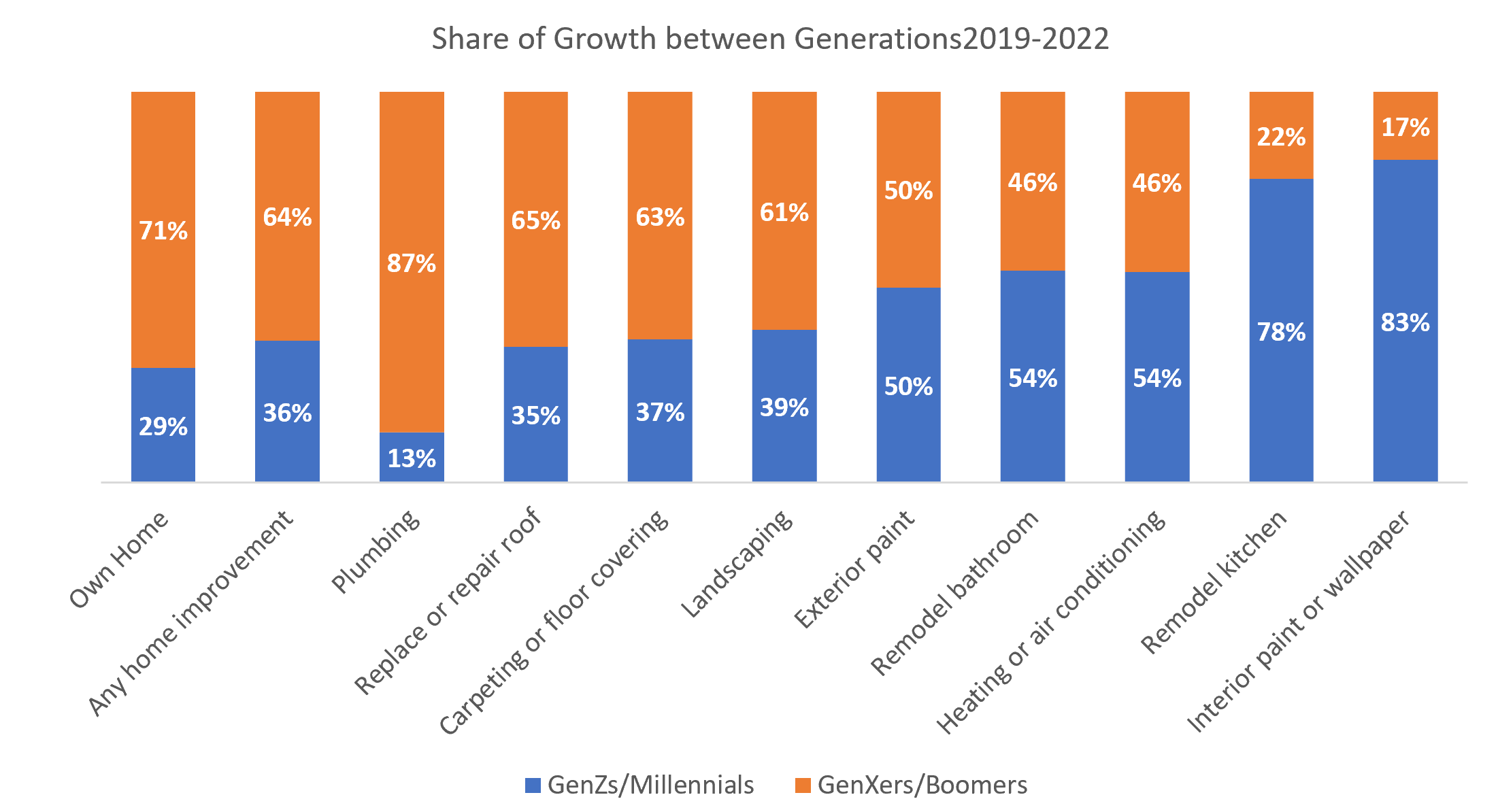

From a generational perspective, GenXers and Boomers have the largest share of any home improvement category at 64%. This is no surprise as older generations tend to have higher rates of home ownership and more disposable income to spend on substantial home improvement projects like roofing, carpeting, flooring, plumbing, and landscaping. On the other hand, GenZs and Millennials are leading the share of growth in simpler home improvement categories among homeowners or renters such as interior painting or wallpapering, remodeling kitchen or bathroom(s), and heating/air conditioning.

Figure 3 Share of Growth 2019-2022 between Generations, SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

Figure 3 Share of Growth 2019-2022 between Generations, SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

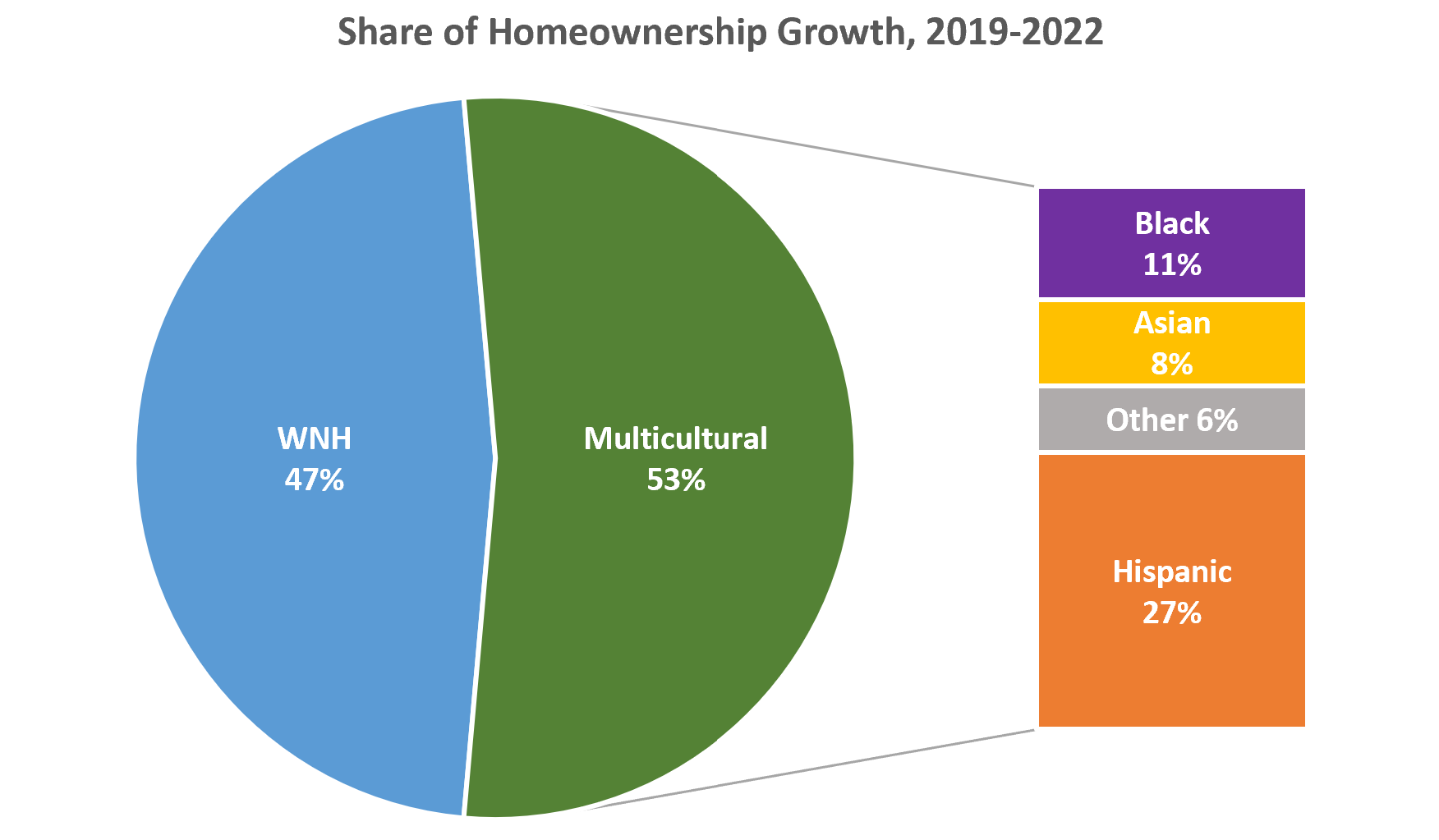

In terms of home ownership in 2022 compared to 2019 (pre-COVID-19 benchmark), Multicultural segments lead in share of growth. In fact, although Multicultural segments account for 44% of the total US population in 2023 according to Claritas, they account for 53% in the share of growth for home ownership. Moreover, Hispanics lead the share of growth among Multicultural segments with 27% of the total, followed by Black with 11%, Asian with 8%, and Other/Multiracial with 6% of the total growth.

Figure 4 Percent Share of Growth for Homeownership, 2019-2022; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

Figure 4 Percent Share of Growth for Homeownership, 2019-2022; SSG Analysis of Scarborough 2019 and 2022 Syndicated Data.

The tremendous growth in home ownership among Multicultural segments has major benefits to the U.S. economy. Homeownership is the first major asset that is typically purchased by couples or individuals creating substantial wealth over time due to consistent long-term appreciation in housing. As the owner builds equity on their home, paying the mortgage on a house creates the opportunity to re-invest some of that equity into the home. This extra wealth from owning a home can be re-invested into the home.

In ancillary categories like Home Improvement, the home improvement space is becoming more Multicultural so marketing and advertising should reflect this change. In the current 2022-23 economic climate of high inflation and increasing interest rates home ownership will slow down, even though home prices may stabilize somewhat. A silver lining from the Chief Economist of The Conference Board Dana M. Peterson, says “…ethnic minority groups might even be able to capitalize on higher interest rates through lower housing costs.”